Are Your Negotiated Carve Out Codes Helping or Hurting Your Practice?

When it comes to collecting insurance reimbursement, the rules are not in your favor, but the...

You’ve gotten your referral, you’ve seen your patient, dictation and documentation are in place. The claim is accepted, and payment has been received. Smooth sailing, right? Maybe.

Electronic payment remittance and automated postings promise a world of synchronized cash collections in as close to real time as possible. Most of the time this goes well.

However, there are plenty of examples when this process makes it harder to find errors when they happen. And unfortunately, they do happen.

Posting errors can not only significantly misrepresent a practice’s account receivables, but can also hide revenue potential.

Some common posting errors that occur despite all the technology consist of:

Errors such as these are not always found in a timely manner and can cause unnecessary financial strain on your patients and practice.

For example, for one practice, we found over $237,000 in posting errors in 6 months. Out of that, approximately $32,000 was recoverable revenue still owed to the practice.

For another practice, we found $408,000 in posting errors with $17,000 in recoverable revenue.

Recovering missing revenue is always a bonus, but often times, a practice finds themselves paying out refunds instead. And with the timeliness in which certain refunds must be paid, like Medicare, it is imperative practices safeguard themselves to stay operationally and fiscally sound.

When payments are posted to incorrect payers, the patient ledger may be accurate, but your payer aging and payer contract compliance reporting will be off.

Example - A $200 payment was due from a commercial PPO plan. However, the system posted that exact $200 payment to the commercial payer’s Health Exchange plan instead of the PPO plan. The commercial payer’s PPO aging reports will show a shortage of $200, and the Health Exchange plan aging reports will show $200 over. Another needle in the haystack to be found.

A robust practice management system may alert you that this payment had ‘issues.’ However, if staff gives a quick glance and looks at the payer’s Explanation of Benefits (EOB) and sees the payment but cannot figure out what the issue is, an adjustment may be made to ‘correct’ the issue which only compounds the issue even further. This happens every day!

Adjustments are ledger bandages that resemble more of a tourniquet. And they can fall on the wrong side of either the debit or credit equation. There are so many variables in medical billing that practices have begun to create custom adjustments for everything from ‘hardship’ to ‘refused’ to ‘move money’ to ‘patient preference’. That’s a whole other blog for another day, however, any adjustment to a billed charge comes with a potential for error.

Standard contractual adjustments are something that systems know how to address and yet errors are found every day. Imagine how many errors could happen with custom adjustments that are manually processed every day.

Transferring an over payment by a patient from one Date of Service (DOS) to another – if you click on debit instead of credit, we have a mess. Do that 10 times to spread out a $500 payment over several dates of service - where do you begin?

Finding these problems can take hours going line by line per patient on a list. Many times, they do not get discovered at all unless you are in a patient’s account looking at another issue. During that time, staff is limited to securing prior authorizations for patients coming in or going after a payer who has mistakenly denied your telehealth visits.

Tackling these errors is key to clean accounting, avoiding unnecessary refunds to patients and/or payers, and inappropriately billing a patient.

Alleviate headaches and burden. Technology with intelligent oncology focused billing logic and rules that dives deep into transaction level data will identify and intervene before problems arise. Safeguarding revenue integrity relieves stress on your team allowing them to focus on prior authorizations and patient care.

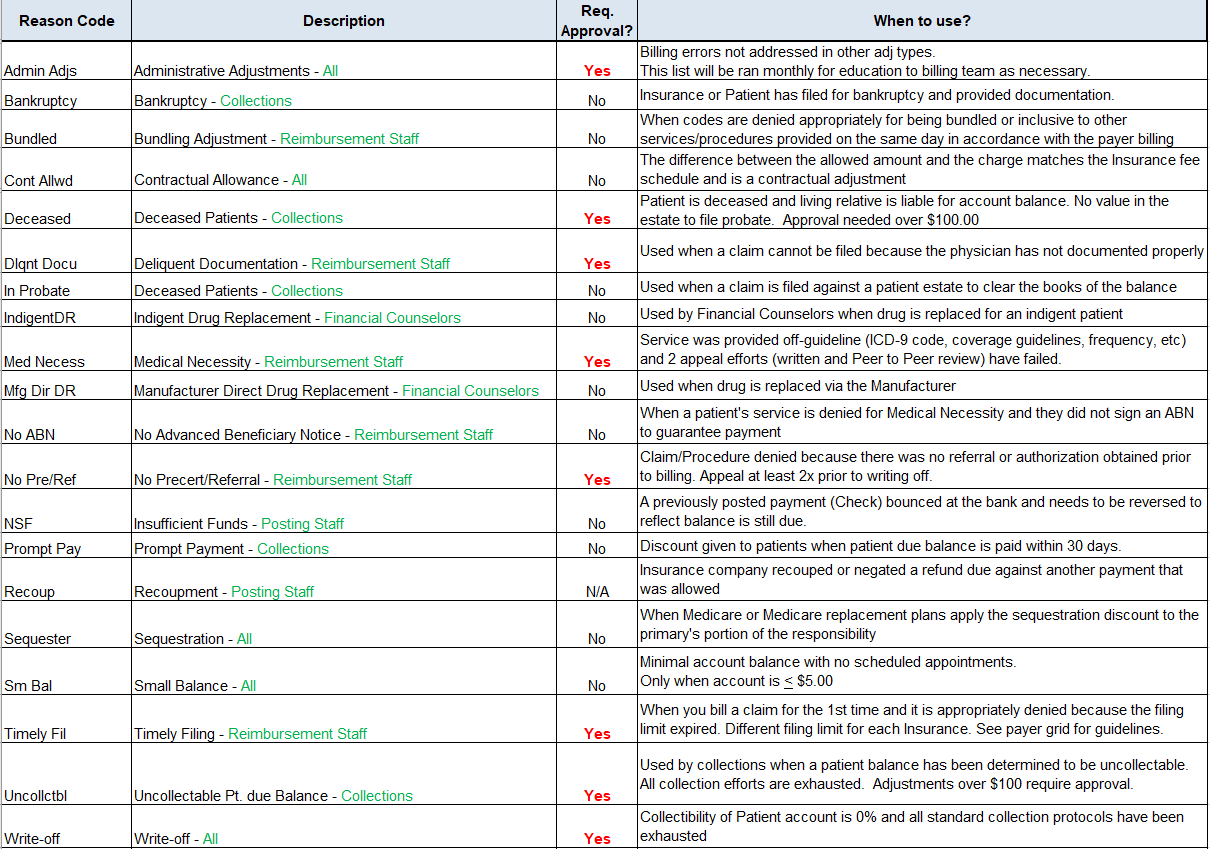

Simplify adjustments. Keep adjustment types to a minimum and standardize the process with a glossary of terms and scenarios so that all billing staff use the appropriate adjustment per situation.

When it comes to collecting insurance reimbursement, the rules are not in your favor, but the...

It’s hard enough that oncology practices are continuously fighting the battle of uncovering payer...

There’s no getting around it: every oncology practice is being underpaid.